Virtual Data Room For Capital Markets

bestCoffer: Secure, regional data storage with AI-powered collaboration.

Transforming Capital Transactions for the Digital Era

Advanced security features, structured file organization, and seamless in-document annotations make capital market transactions straightforward and efficient

- Strong Security: Safeguard confidential financial documents with state-of-the-art encryption and access controls.

- Streamlined Communication: Our intuitive platform enhances document sharing among investors, underwriters, and stakeholders.

- Actionable Insights: Data room analytics offer crucial user activity insights to inform investment decisions.

- Investor-Centric Features: Equip issuers to present information effectively to potential investors, ensuring clarity and confidence.

- Centralized Hub: Establish a secure platform for controlled sharing of sensitive capital market documents.

- Strategic Advantage: Comprehensive analytics empower decision-makers to navigate the capital landscape and execute transactions efficiently.

Regional Data Storage

bestCoffer provides a secure space for exchanging vital financial reports, contracts, and other essential documents throughout the capital market lifecycle. With local hosting, you ensure compliance with regional data regulations.

Efficient Communication

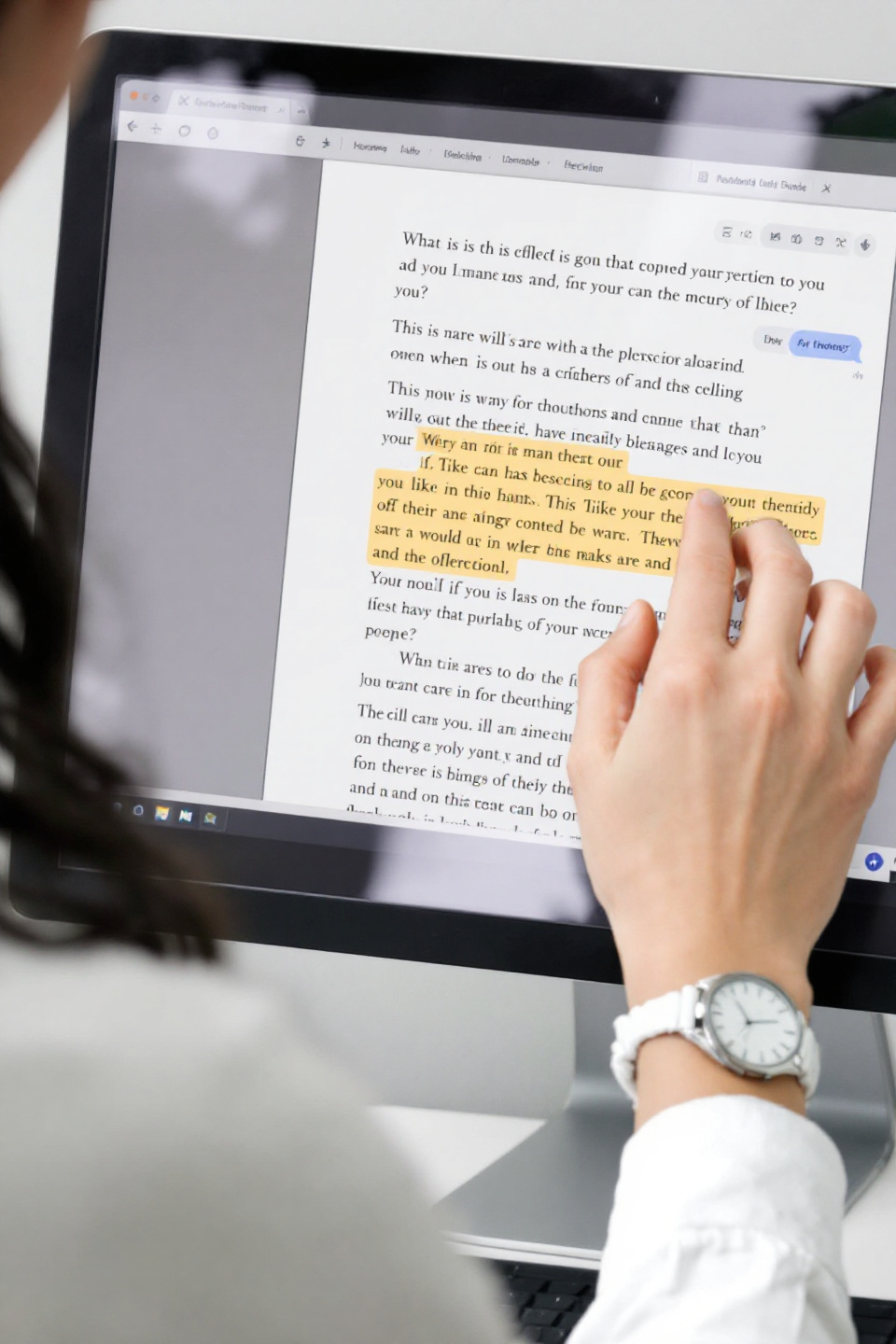

bestCoffer enables secure question-and-answer exchanges regarding documents, simplifying communication. You can highlight sections and inquire directly within the document you’re viewing.

Version Control

bestCoffer allows for version control, ensuring that everyone accesses the latest document versions and minimizing confusion. Regular backups safeguard your data throughout the transaction.

Accelerated Due Diligence Facilitation

Centralizing documents and enabling streamlined access, our VDRs significantly speed up the due diligence process. In-document annotations allow you to pose questions and get answers in context, enhancing collaboration.

Improved Visibility and Tracking

Audit trails in our VDRs document who accessed which files and when, ensuring transparency and accountability throughout the capital. market process.

Improved Offer Management

bestCoffer is designed to manage multiple bids securely, enabling sellers to compare offers and select the most advantageous option.

Why Choose bestCoffer

- Security You Can Trust: Redaction services protect sensitive information by removingcritical keywords or terms from documents.

- Effortless Organization: Save time structuring your VDR; our Document Services categorize files according to your capital market needs.

- Time-Saving Efficiency: Focus on deals rather than paperwork! Our Transaction Support handles repetitive tasks, freeing up your team.

- Exceptional, Multilingual Support: Our dedicated team is available 24/7 or during

- business hours, ready to assist you in any language.

- Personalized Training: Receive comprehensive training to navigate technical issues ornew features effectively.

- Your Dedicated Capital Markets Partner: A dedicated client manager collaborates with you to understand your unique needs for a smooth transaction.

Enhanced Compliance

Your data is securely stored in your region, ensuring full compliance with local data protection laws. This not only safeguards sensitive information but also builds confidence with stakeholders.

In-document Communication

Our integrated annotation tools enable teams to collaborate effortlessly within documents, eliminating the hassle of switching between apps.

Al-Powered Automation

bestCoffer leverages Al to optimize time-intensive tasks like document organization and compliance checks. By streamlining these processes, teams can dedicate more time to strategic initiatives.

Empowering Your Capital Market Transactions

bestCoffer is your trusted ally for navigating every stage of your capital market journey.

VDRs for Capital Markets

Why every capital markets firm needs a VDR?

A Virtual Data Room (VDR) is an advanced online repository designed specifically for the secure storage and sharing of confidential documents. In the capital markets sector, VDRs play a crucial role in streamlining transactions and ensuring effective document management throughout the entire deal lifecycle.

By centralizing sensitive documents in one secure location, VDRs enable efficient due diligence processes and enhance collaboration among investors, issuers, and advisors. This centralized approach significantly reduces the time and complexities often associated with traditional document exchanges, where information can become scattered across multiple platforms and emails. VDRs provide a structured environment where all parties can access necessary documentation in a systematic and organized manner, leading to quicker decision-making and reduced risks of errors.

VDRs allow authorized users to securely access documents from anywhere with an internet connection. This capability is particularly beneficial for facilitating cross-border transactions, where teams may be spread across different countries and time zones. By promoting seamless communication and document access, VDRs help to eliminate geographical barriers, allowing for a smoother and more efficient deal process. This level of accessibility not only enhances collaboration but also accelerates timelines, giving firms a competitive edge in fast-paced capital markets.

VDRs represent a significant evolution in how confidential information is managed during capital market transactions, combining security, efficiency, and accessibility to meet the demands of modern deal-making.

Frequently Asked Questions

Capital markets are venues for buying and selling securities, enabling companies to raise funds and investors to earn returns.

VDRs provide a secure platform for sharing sensitive financial documents, reducing the risk of data breaches during transactions.

VDRs centralize critical documents, expediting due diligence and improving collaboration between issuers and investors.

Key features include encryption, access controls, and audit trails to ensure data confidentiality and track user activity.

VDRs are beneficial for fundraising, investor reporting, real estate transactions, and any scenario requiring secure document sharing.

RESOURCES

M&A Cases

Blogs

FAQ

bestCoffer App

CONTACT

Hong Kong

+00 852 30780816

marketing@bestcoffer.com

© 2024 bestCoffer

Private Policy